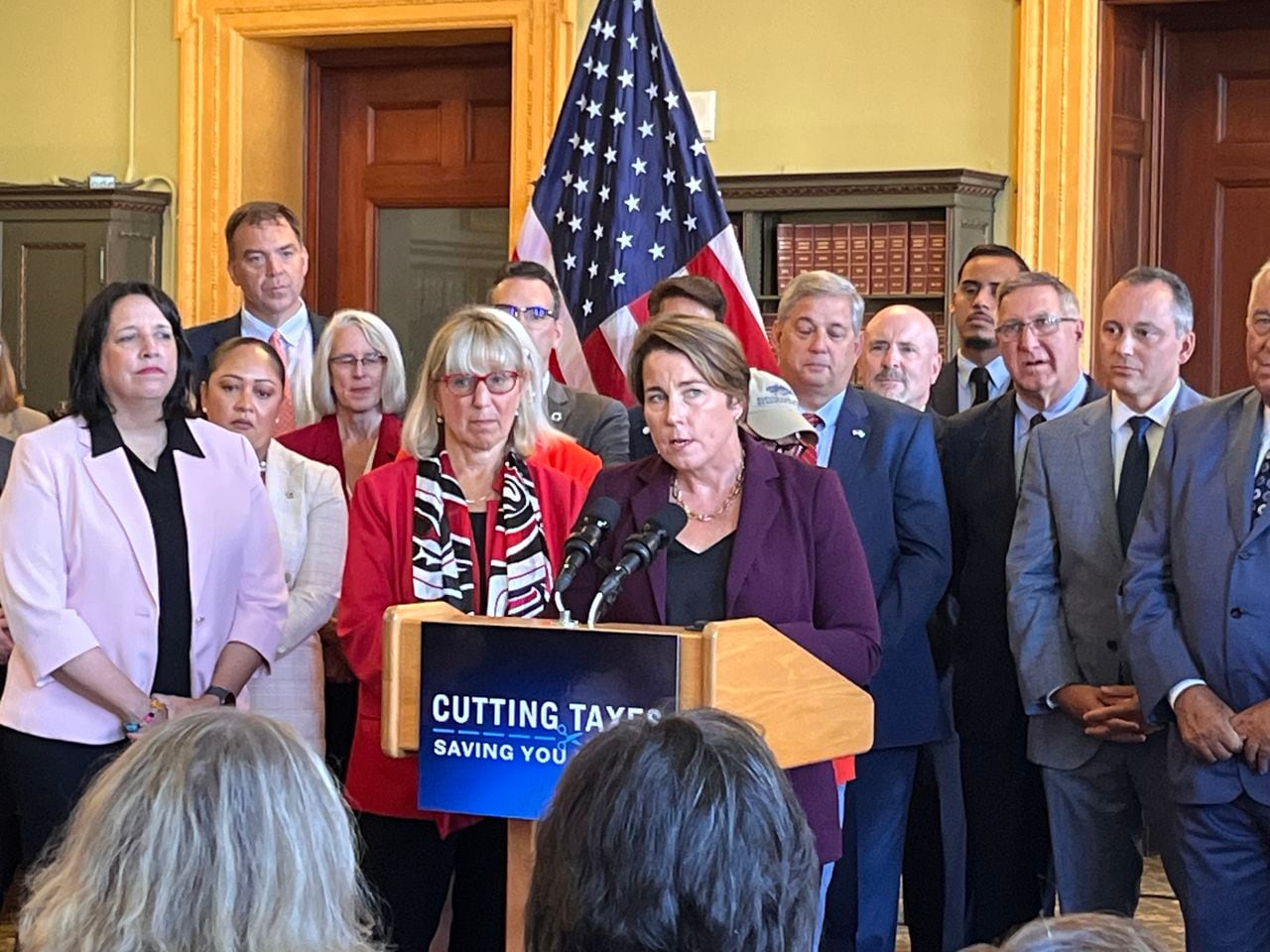

Last October, during a news conference at the State House, Gov. Maura Healey, flanked by Lt. Gov Kim Driscoll, and allies in the state House and Senate, signed a sweeping package of tax cuts into law.

“Tax cuts are here in Massachusetts. They are here for everyone. And they are going to save you money,” the Democratic governor said at the time.

The law formally took effect on Monday, with breaks headed to renters, families, seniors, and businesses across the commonwealth. All told, the package that Healey signed into law will deliver $561 million in relief this year, rising to $1 billion by the 2027 budget year, State House News Service reported.

Here’s a look at where — and how — you’ll save money.

Families and Seniors

The product of painstaking negotiations between the Democratic administration and their compatriots in the majority-Democrat Legislature, the law channels some serious relief to Massachusetts families.

The bill more than doubles the state’s child and dependent tax credit, taking it from $180 to $310 for qualifying dependents this year, and then to $440 for every qualifying dependent in 2024 and beyond, MassLive previously reported.

All told, more than 565,000 families statewide are expected to benefit from the change, according to published reports.

The compromise bill approved by lawmakers last fall also doubles the maximum tax credit for senior citizens who rent or own homes in the Bay State from $1,200 to $2,400, an increase that is estimated to help 100,000 seniors who struggle with housing costs to stay in their residences.

In a year-end interview with MassLive, Healey touted the benefit of the tax cut package for all state residents, calling them a key part of “making Massachusetts more competitive.”

Renters

Under language that took effect Monday, the state’s deduction for renters rose from $3,000 to $4,000 in an effort to tame spiraling rent prices that have seen the Bay State outpace other states.

In November, the median rent for a one-bedroom apartment in Boston was $2,990, according to a report by the property rental site Zumper. The state’s largest city edged out the median price in San Fransisco, $2,970, to move up to the third spot on the list, MassLive previously reported.

That break comes even as Healey and lawmakers launch a concerted effort, in the form of $4.12 billion housing bond bill that’s expected to lead to the creation of as many as 40,000 new homes when it’s partnered with the tax relief package, MassLive previously reported.

“I’m a cheerleader for Massachusetts, but people can’t expect it to live in Massachusetts, and we can’t expect employers to locate or grow in Massachusetts, unless people can afford housing,” Healey told MassLive.

“And the fact of the matter is, across the state, no matter the region … rents have gone up people; can’t afford rent, they can’t afford down payments, they can’t afford to downsize in some instances, because there’s not another place to move to,” Healey continued. “And it puts us at a real competitive disadvantage.”

Business Tax Cuts

The compromise bill that lawmakers passed, and Healey signed, includes a raft of tax changes supported by the state’s business community, which has raised alarms about the exodus of Massachusetts residents to other states.

A new “movers” report by United Van Lines buttresses those concerns with data, showing that more people (56.6%-43.4%) left the state than moved into Massachusetts last year. And the bulk of those leaving earning $150,000 a year or more.

The law includes, for instance, a uniform estate tax credit of $99,600, which effectively doubles the threshold of where the tax kicks in from $1 million to $2 million, according to State House News Service. The change costs $128 million in the 2024 budget year, rising to $213 million by the 2027 budget year, State House News Service further reported.

The law also cuts the state’s short-term capital gains tax from 12% to 8.5%, WCVB-TV reported.

The bill “demonstrates that the Legislature prioritizes our state’s workers, employers, and economic competitiveness,” James E. Rooney, the president and CEO of the Greater Boston Chamber of Commerce, said in a statement last fall.

“As we continue to advance our competitive edge, tax relief and a strong business climate will help ensure that the Commonwealth attracts and retains residents and businesses, especially as other states actively pursue our talent and companies,” Rooney continued.

Paul D. Craney, a spokesperson for the business-friendly Massachusetts Fiscal Alliance, told MassLive that the relief bill effectively amounts to an inflationary adjustment that “didn’t really move the needle that much.”