(*This story was updated at 7:21 a.m. on Saturday, Dec. 30, 2023, with additional reporting.)

Free school lunches. Road and bridge repairs. New bicycle lanes. Free community college for thousands of students. Expanded financial assistance for public college and university students.

Those are just some of the initiatives that have gone from drawing board to reality since Massachusetts voters approved the commonwealth’s Fair Share Amendment, a 4% tax on Bay State residents who earn more than $1 million a year.

Popularly referred to as the “Millionaires’ Tax” the levy is expected to pump as much as $1.5 billion into the commonwealth’s coffers in its first year, according to advocates and Gov. Maura Healey’s administration.

The levy, authorized through a constitutional amendment in November 2022, put Massachusetts in the vanguard of states that have asked their wealthiest residents to pay more toward the common good. Other states, including California, Connecticut, Maine, New Jersey, New York, and Washington D.C., adopted millionaire taxes of their own, according to one analysis.

In an email, Healey spokesperson Karissa Hand said the current year’s state budget made “makes strategic use of $1 billion in new revenue generated from the voter-approved Fair Share income surtax for the first time.”

That “establishes a blueprint for how this revenue will be tracked and spent in future years on priorities in education and transportation, as directed by the voters,” Hand said.

Revenue from the tax provides $524 million in funding for education, including $71 million for early education and care; $224 million for K-12 education, and $229 million for higher education, Healey’s office said in an email.

A further $477 million for transportation funding will provide a shot in the arm to the MBTA and regional transit agencies, and more money for road and bridge repairs, according to the administration.

Where it’s hurt

But apart from the numbers, the tax remains as hotly debated as it was when it went before the electorate in November 2022, with advocates hailing it as a badly needed leveling of the playing field, and critics lambasting it as a drag on the state’s economy that’s helping to fuel an exodus of residents.

That notably included former Boston Celtics player Grant Williams, who was dealt to the Dallas Mavericks last summer.

The NBA star, who won’t pay any income tax in Texas and will earn more money in the Lone Star State, said the tax played a role in his decision to leave the state, according to the Massachusetts Fiscal Alliance, a business-friendly think tank in Boston.

A spokesperson for the group, Paul D. Craney, told MassLive that legislative leaders and Healey need to take dramatic steps to improve the state’s economic competitiveness to counter what he said is the economic damage that’s being done by the tax.

“Other states know they can continue to lure high-income earners and business because Massachusetts has not responded to the income surtax in an appropriate way,” Craney said. “It will continue to ravage our competitiveness. Other states will continue to prey on us because this is on the books.”

In particular, that’s New Hampshire and Florida, which are the top two destinations for Massachusetts residents seeking more tax-friendly climates. Officials there are tweaking their laws to make their states more desirable.

“This will continue to impact [Massachusetts],” Craney told Masslive. “Other states are aware of this income tax hike. It’s given … states that are highly competitive with Massachusetts the ability to plan ahead.”

What the data says

A report released earlier this fall by the nonpartisan Tax Foundation ranked the Bay State 46th in the nation for its business tax climate, ahead of only neighboring Connecticut, as well as California, New York and New Jersey.

All told, Massachusetts slid 12 places in the rankings list since last year — further than any other state in the nation, according to the Tax Foundation’s analysis.

The wealth tax was a prime driver of that decline, according to the Tax Foundation’s analysis, as it hiked the the state’s top marginal individual income tax rate from 5% to 9%, MassLive previously reported.

That change “represents a stark contrast from the recent reforms to reduce rates while consolidating brackets in many other states,” the analysis further noted.

Craney echoed that sentiment, telling MassLive that “we know for a fact what it has done to our business climate, the data has been pretty clear.”

Another analysis by the Massachusetts Taxpayers Foundation showed the state losing 111,000 people between April 2020 and July 2022, WGBH News reported. That’s before the tax went on the books. Even so, that analysis cited the state’s high cost of living as one of the main drivers of the exodus.

Where it’s helped

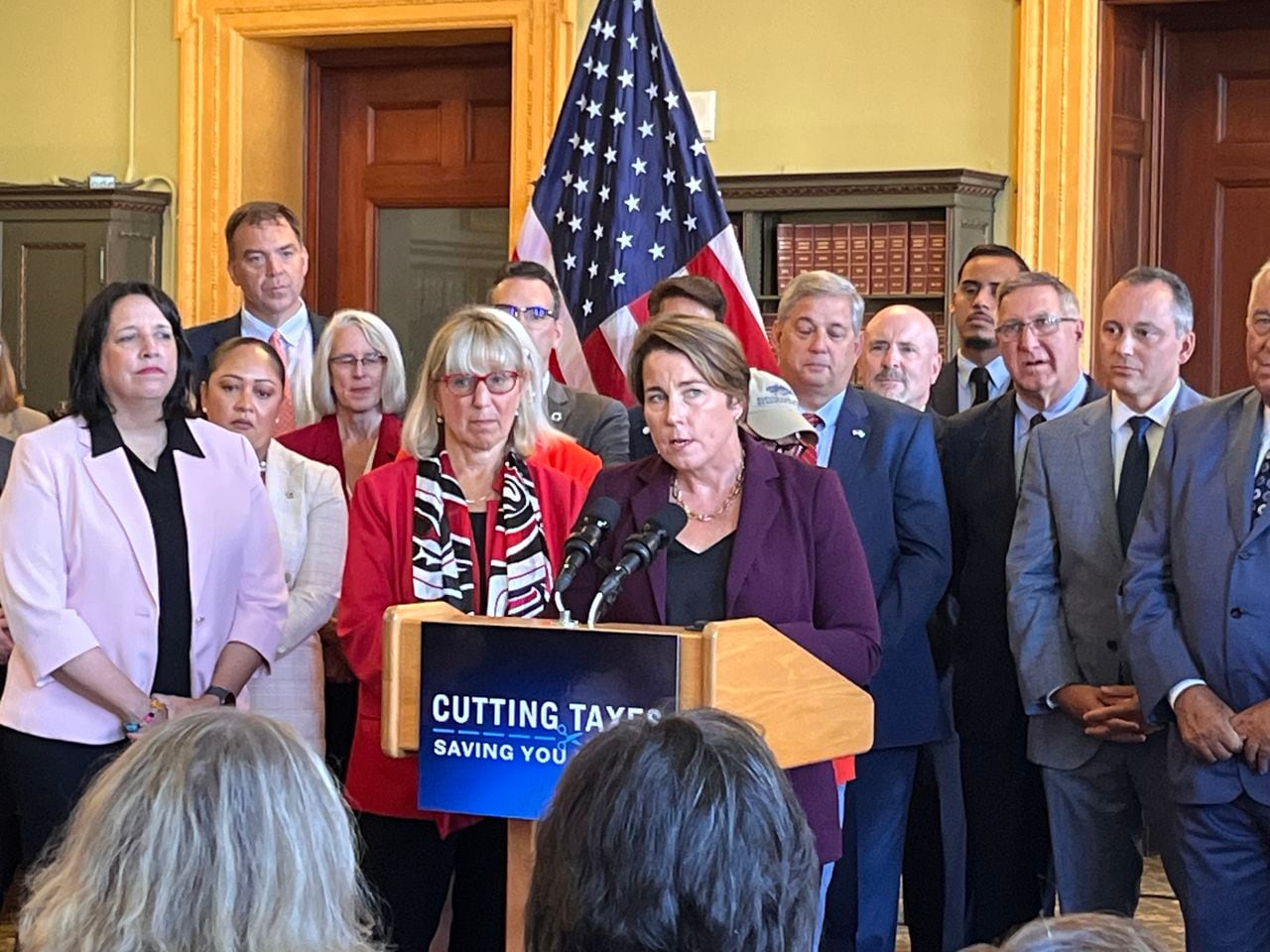

In a year-end interview with MassLive, Healey touted the $1 billion tax relief package that state lawmakers passed, and she signed into law, in October, saying that it will make the state “more affordable” for more people.

The Democratic administration also has not been shy about bragging out the benefits of the Millionaires’ Tax, doing so as recently as this month, as it announced it was channeling $100 million in infrastructure aid to all 351 cities and towns because of the levy.

The administration also used money from the levy to pay for free school lunches for every child in the state, according to CBS News, making Massachusetts the seventh state in the nation to do so.

Revenue from the tax also underwrote the state’s MassReconnect program, which provides free community college to students aged 25 and older and to nursing students of any age.

One of the legislative architects of that plan, Senate President Karen Spilka, D-Middlesex/Norfolk, said she hoped to expand that tuition benefit to all community college students in 2024.

“This year, we laid the groundwork for free community college,” Spilka told MassLive in an email. “In 2024, we’re going to follow through and work to make it a reality.”

For Andrew Farnitano, a spokesperson for Raise Up Massachusetts, which led the charge for the change, it’s proof that policymakers are heeding the will of the voters, who said they wanted the money allocated for new spending on schools and transportation.

“Over the past few months, we’ve seen the impact, and that will only grow,: Farnitano told MassLive, adding that collections from the tax are expected to increase as much as $2 billion by the 2025 budget cycle.

And that’s been true even at a time when overall state tax collections are stumbling, he added.

Through mid-December, the state collected $1.54 billion in taxes, which was $138 million, or 8.2% less, than the same period in December 2022, according to state Revenue Department data.

“We always maintained that this amendment was not about a single budget cycle or a single year,” Farnitano said. “It’s a long-term change to our income tax structure to make our tax system more fair and economically progressive.”