Asking students borrowers to resume their loan payments when the federal government is on the brink of a shutdown is “a recipe for disaster,” a Massachusetts lawmaker said Wednesday, as she called for a freeze on those payments until Washington gets its fiscal house in order.

“This Republican government shutdown stands to harm families across the nation, many who were just regaining their financial footing for the first time since the COVID-19 crisis,” U.S. Rep. Ayanna Pressley, D-7th District, said in a statement. “The [Biden] administration should absolutely pause student loan payments and interest accrual in light of these stark realities.”

The lights could go out on the federal government as soon as Sunday if lawmakers on Capitol Hill fail to pass the spending bills needed to pay the bills. Conservatives in the U.S. House have pressed for deep spending cuts that have little chance of passing the majority-Democrat U.S. Senate.

And while lawmakers were working Wednesday to break the logjam, the likelihood of a shutdown increased after House Republicans shot down a bipartisan Senate plan to keep the government funded, the Washington Post reported.

After a pandemic-inspired pause, interest on student loan debt kicked back in on Sept. 1. Borrowers will be required to start repaying their loans in October.

That break from payments “has been a lifeline for borrowers across the nation. As we stare down an impending Republican government shutdown, it is abundantly clear that student loan payments should not resume Oct. 1,” Pressley said.

Asking student borrowers to resume payments with the U.S. Department of Education likely hobbled would undo the economic progress borrowers made during the more than three-year pandemic pause on repayments, Pressley argued Wednesday.

“To throw borrowers back into repayment with bad-faith loan servicers and an under-staffed Department of Education is a recipe for disaster and would deeply undermine the progress we have made to advance economic justice for student loan borrowers,” the Massachusetts Democrat said.

Pressley called on the White House to “take immediate steps to prevent borrowers from entering into repayment at a time when the infrastructure is not there and bad actors will seize on the lack of government capacity caused by Republican dysfunction.”

In 2019-20, 56% of Massachusetts college graduates had some student debt, with an average of $33,457, according to data compiled by the Institute for College Access and Success. That was the eighth-highest tally nationwide.

About a third of those students, 31%, had non-federal debt, which often is costlier and carries fewer consumer protections than federal debt, the institute said in a statement.

The largest component was private student loans, offered by banks and private lenders. About 14% of the commonwealth’s students had such debt, with an average debt of $42,748, the institute’s data indicated.

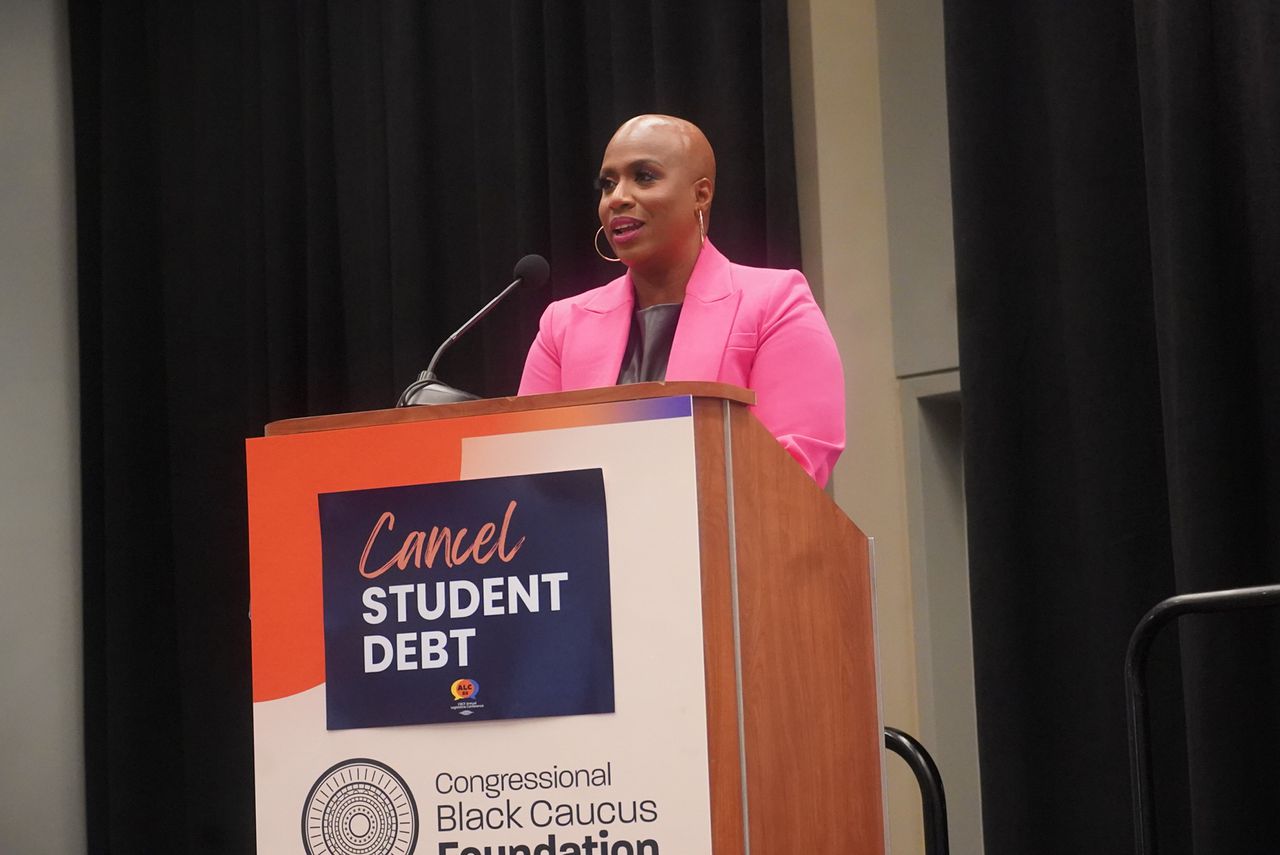

Last weekend, Pressley issued a renewed call to cancel student loan debt for tens of thousands of borrowers, arguing that it’s “a racial justice imperative.”

“Student debt cancellation is essential and it is a racial justice imperative,” Pressley said in a statement. “Black folks—especially Black women—are among the most impacted by the student debt crisis, so we must be intentional in centering their voices and experiences in our policy response. Student debt cancellation is essential.”